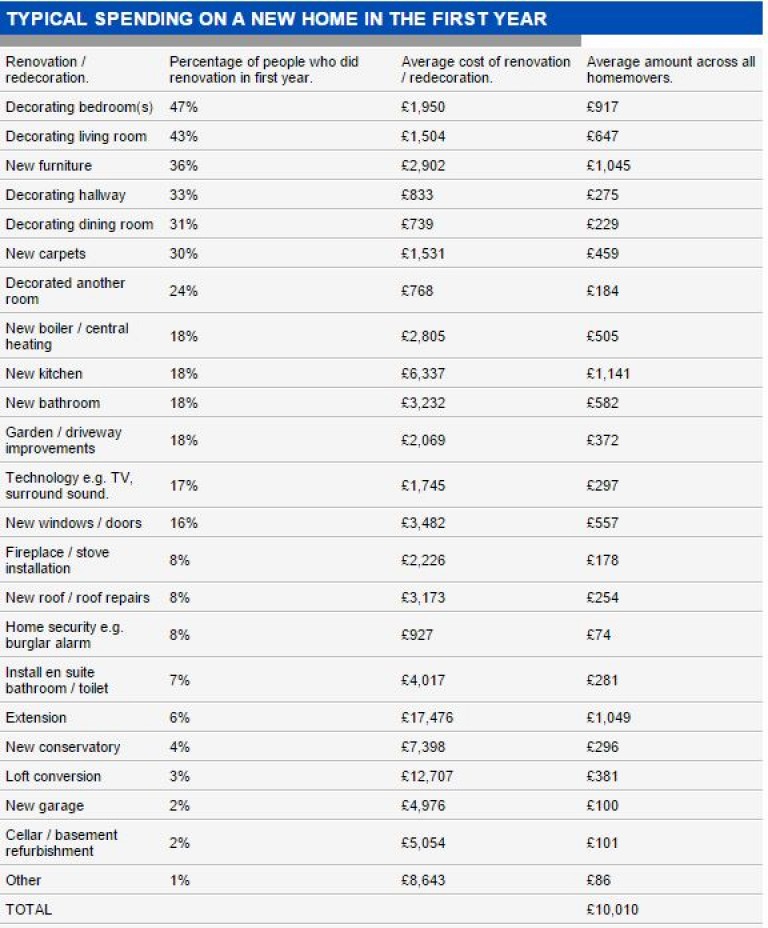

How much you typically spend on a new home in the first year

Homebuyers are often warned to budget for solicitors' and chartered surveyors' fees, as well as stamp duty and extra mortgage charges.

But the biggest expense is often not factored in: redecoration, repairs and renovation. On average new homeowners spend more than £10,000 doing up their property in the first year - with one in five paying for the renovations on their credit card, new research has revealed.

It equates to a total first-year home makeover cost of £6.8billion, based on the near-670,000 moves that happen each year, according to the study by insurer Aviva. It found 47 per cent of buyers transform their bedrooms within the first year of moving, with 43 per cent changing their living rooms.

One in five movers install new kitchens during this period, while the same amount also splashes out on new bathrooms.

The research reveals a love of fires among movers, with one in 12 investing in stoves and fireplace, whereas an ambitious 6 per cent go to the extent of building an extension.

A quarter of movers indulge in new furniture and 17 per cent buy new technology, such as televisions and surround sound systems.

However, the research reveals Britons are far more likely to make cosmetic changes to their new homes than investing in home security. Only 8 per cent of new movers said they purchased any sort of security system in their first year.

Less than half of movers said they updated their home insurance - buildings or contents - after they updated their properties, meaning that some homeowners may be underinsured if they have made expensive purchases or changes to their homes.

More than 60 per cent of people use savings to pay for the renovations, but 19 per cent put the expenses on credit cards, with 10 per cent happy to 'buy now pay later' with store credit.